Driving under the influence can have several disastrous effects on your personal life, and one of the unintended consequences of driving under the influence is seeing your car insurance rates rise afterwards. Here’s what you need to know about how driving under the influence affects your Car Insurance.

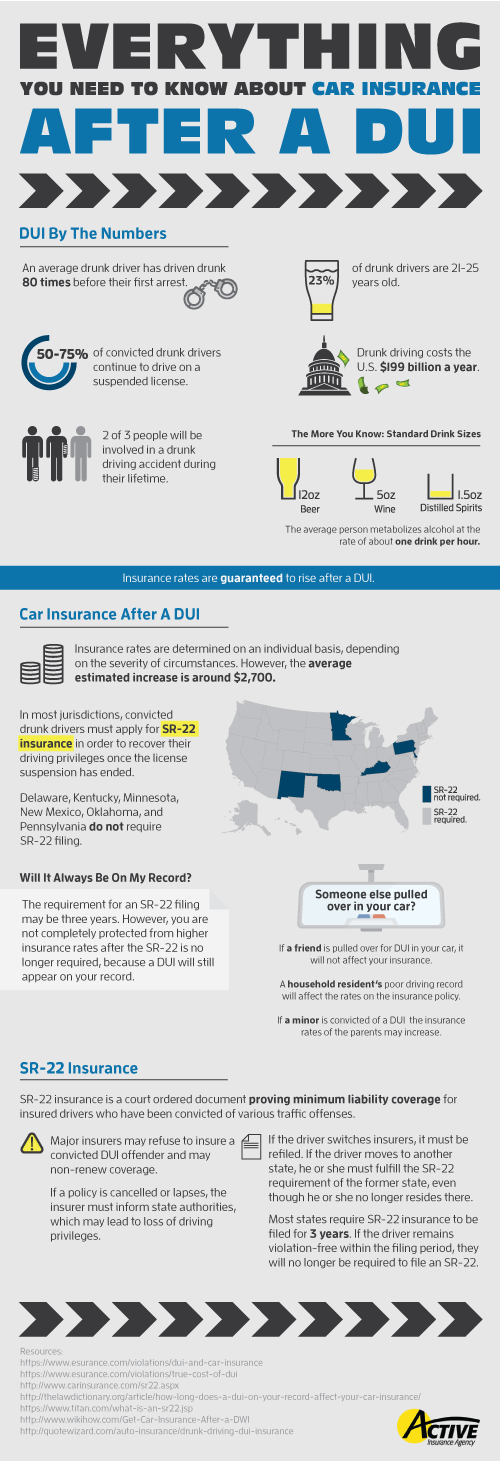

First, a little bit of background on driving under the influence. People who drive under the influence tend to repeat the risky behavior; in fact, an average drunk driver has driven drunk 80 times before his or her first arrest, and 50-75% of convicted drunk drivers continue to drive on a suspended license. Drunk drivers also skew towards the younger side, with 23% of drunk drivers in the 21-25 year age range. Since the average person metabolizes alcohol at the rate of about one drink per hour, 12 ounce beers and 5 ounce glasses of wine can pile up quickly, leaving the drinker unsure about their state of sobriety when preparing to get behind the wheel.

Unfortunately, two out of three people will be involved in a drunk driving accident during their lifetime, and drunk driving costs the U.S. an astonishing $199 billion per year. Convicted drunk drivers will also see a significant cost after getting a DUI. While Car Insurance rates are determined on an individual basis (depending on the circumstances), the average estimated increase in car insurance after a DUI is around $2,700.

Unfortunately, two out of three people will be involved in a drunk driving accident during their lifetime, and drunk driving costs the U.S. an astonishing $199 billion per year. Convicted drunk drivers will also see a significant cost after getting a DUI. While Car Insurance rates are determined on an individual basis (depending on the circumstances), the average estimated increase in car insurance after a DUI is around $2,700.

Car Insurance

In most jurisdictions, convicted drunk drivers must apply for SR-22 insurance in order to earn back their driving privileges once the license suspension has ended (Delaware, Kentucky, Minnesota, New Mexico, Oklahoma, and Pennsylvania do not require an SR-22 filing). The requirement for an SR-22 filing may be up to three years; however, you may still encounter higher insurance rates after the SR-22 is no longer required, because the DUI will still appear on your record.

Some unusual circumstances may arise that affect your insurance rates. For example, if a friend is pulled over for a DUI while driving your car, it will not affect your Car Insurance. However, a household resident’s poor driving record will affect the rates on the Car Insurance policy, and if a minor is convicted of a DUI, the insurance rates of the parents may increase as a result.

If your jurisdiction requires SR-22 filing after a DUI, it’s important to know the basics of the document. SR-22 insurance is a court-ordered document proving minimum liability coverage for insured drivers who have been convicted of various traffic offenses. In some cases, major insurers may refuse to insure a convicted DUI offender and may non-renew coverage. If an Car Insurance policy is cancelled or lapses, the insurer must inform the state authorities, which may lead to loss of driving privileges.

In the event that a driver switches insurers, the SR-22 must be refiled. If the driver moves to another state, he or she must fulfill the SR-22 requirement of the former state, even though he or she no longer lives there. Finally, most states require SR-22 insurance to be filed for three years. If the driver remains violation free within the filing period, he or she will no longer be required to file an SR-22.

Besides drastically changing your life for the worse, driving under the influence can come with a hefty price tag. If you need help filing an SR-22 or have further questions about car insurance after a DUI, contact Active Insurance Agency today.

Some unusual circumstances may arise that affect your insurance rates. For example, if a friend is pulled over for a DUI while driving your car, it will not affect your Car Insurance. However, a household resident’s poor driving record will affect the rates on the Car Insurance policy, and if a minor is convicted of a DUI, the insurance rates of the parents may increase as a result.

If your jurisdiction requires SR-22 filing after a DUI, it’s important to know the basics of the document. SR-22 insurance is a court-ordered document proving minimum liability coverage for insured drivers who have been convicted of various traffic offenses. In some cases, major insurers may refuse to insure a convicted DUI offender and may non-renew coverage. If an Car Insurance policy is cancelled or lapses, the insurer must inform the state authorities, which may lead to loss of driving privileges.

In the event that a driver switches insurers, the SR-22 must be refiled. If the driver moves to another state, he or she must fulfill the SR-22 requirement of the former state, even though he or she no longer lives there. Finally, most states require SR-22 insurance to be filed for three years. If the driver remains violation free within the filing period, he or she will no longer be required to file an SR-22.

Besides drastically changing your life for the worse, driving under the influence can come with a hefty price tag. If you need help filing an SR-22 or have further questions about car insurance after a DUI, contact Active Insurance Agency today.

How to Prep Your Car to Get the Most Out of a Sale

Start with the obvious fixes. Sure, your car may be reliable and get great gas mileage, but your potential buyers aren’t going to be impressed if it’s not looking up to speed. Replace any old and worn-down floor mats and use upholstery cleaner on the carpeted areas. Remove old bumper stickers using bumper cleaner, and wax your dashboard to a polished shine.

Check the body of your car for any paint swirls, chips, scratches or dents. Color polish can take care of paint swirls and return brightness to sun-damaged paint. You can also pick up a touch-up kit to address any chips in your car’s paint job; this kit should include primer, paint, and lacquer that match the color of your car. You can take care of shallow scratches yourself with scratch repair products, but deeper scratches will need to be professionally filled and repainted. Similarly, leave repairing dents to the professionals (look for a paint less dent repair service so that your vehicle’s factory paint job isn’t compromised). It should go without saying that your car should also get an incredible wash before anyone comes to see it.

Next, make sure that your car is running smoothly. Begin by getting your car professional inspected so that you know what small problems you have to fix. Check your brake lights, headlights, and hi-beams to make sure none of them are malfunctioning or out (a potential buyer would be disappointed if such an obvious problem wasn’t fixed beforehand). Make sure your fluid levels are topped off and your windshield wipers are running correctly.

Check the body of your car for any paint swirls, chips, scratches or dents. Color polish can take care of paint swirls and return brightness to sun-damaged paint. You can also pick up a touch-up kit to address any chips in your car’s paint job; this kit should include primer, paint, and lacquer that match the color of your car. You can take care of shallow scratches yourself with scratch repair products, but deeper scratches will need to be professionally filled and repainted. Similarly, leave repairing dents to the professionals (look for a paint less dent repair service so that your vehicle’s factory paint job isn’t compromised). It should go without saying that your car should also get an incredible wash before anyone comes to see it.

Next, make sure that your car is running smoothly. Begin by getting your car professional inspected so that you know what small problems you have to fix. Check your brake lights, headlights, and hi-beams to make sure none of them are malfunctioning or out (a potential buyer would be disappointed if such an obvious problem wasn’t fixed beforehand). Make sure your fluid levels are topped off and your windshield wipers are running correctly.

0 comments:

Post a Comment